So, I was thinking about how everyone’s buzzing about yield farming these days. Seriously, the promise of “easy money” from staking rewards sounds too good to be true, right? But here’s the thing: in the Solana ecosystem, these opportunities aren’t just some flash-in-the-pan trend—they’re evolving, nuanced, and kinda wild if you dig deeper.

Yield farming, staking, portfolio tracking—they all blend together in this crazy dance that’s as much about patience as it is about timing. My first gut feeling was, “Great, another DeFi fad.” But after poking around, I realized there’s a lot more beneath the surface. Initially, I thought this was all high risk, low control. Actually, wait—let me rephrase that: it’s high risk, but with better tools, you gain more control than you might expect.

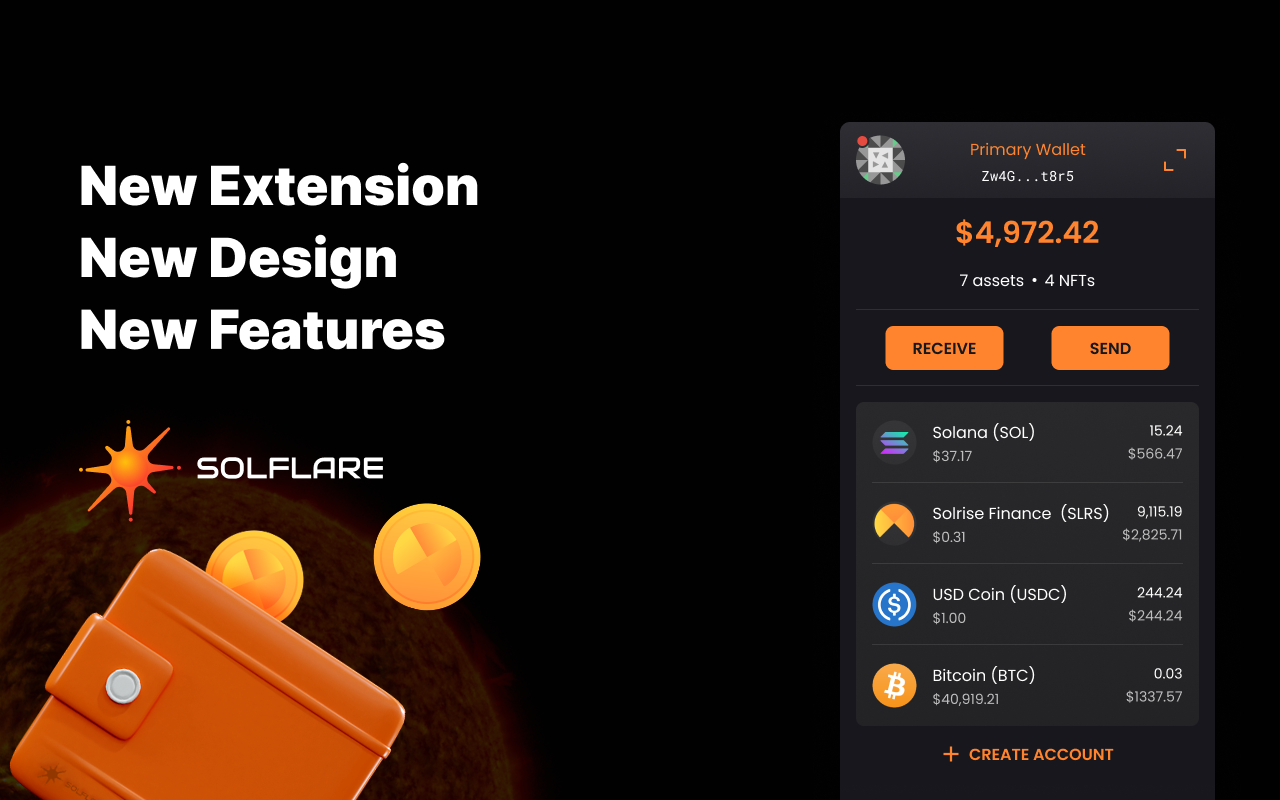

Woah! Did you know some folks are stacking rewards on Solana with practically no downtime? Sure, there are hacks and rug pulls out there, but the ecosystem’s maturing fast. And honestly, managing your assets without a reliable wallet is like driving blindfolded. That’s why I keep coming back to the solflare wallet. It’s not just about storing coins; it’s about seamlessly tracking your portfolio and staking rewards in one place.

Now, I’m not saying it’s perfect—there’s always that nagging worry about network congestion or unexpected slashes. But from what I’ve seen, the interface and security features give me enough confidence to stake my SOL without losing sleep. And hey, if you’re serious about yield farming, you kinda need that peace of mind.

Really? Yeah, because at the end of the day, the difference between winning and losing in DeFi often boils down to how well you can track and manage your positions. That’s where the tools like solflare wallet shine—they bring analytics and ease of use into a space that can otherwise feel overwhelming.

Yield Farming: More Than Just Chasing Returns

Okay, so check this out—yield farming started as this shiny new way to earn passive income by locking up tokens and hopping between liquidity pools. But it’s gotten way more sophisticated. With Solana’s lightning-fast transactions and low fees, yield farming feels less like gambling and more like strategic investing. At least, that’s the vibe I get after messing with a few protocols.

On one hand, staking rewards seem straightforward: lock your tokens, earn interest. Though actually, the mechanics behind how rewards are calculated, compounded, and distributed can get very complicated. You might be earning rewards in multiple tokens or compounding those rewards automatically, but keeping track without a solid interface? Forget it.

Here’s what bugs me about some platforms—they don’t offer clear insights into your APR changes or impermanent loss risks. Plus, if you’re juggling several staking pools, it’s easy to lose track of where your returns are coming from. This is why I started using portfolio trackers integrated with wallets. The solflare wallet does this pretty well, offering real-time updates and clear breakdowns.

Yield farming isn’t all sunshine and rainbows though. Sometimes, the protocols change their reward rates or governance votes shift incentives overnight. You gotta be on your toes. That’s why automating alerts and portfolio tracking is not just convenient—it’s necessary.

Hmm… I remember when I first tried yield farming on Solana. I was excited but totally overwhelmed by how fast things changed. I had to constantly check multiple dashboards, and honestly, it felt like spinning plates. That’s when I realized how valuable a unified wallet and tracker could be.

Staking Rewards: The Long Game and the Short Hustle

Staking feels like the OG of DeFi income streams. You lock your SOL, help secure the network, and get rewarded. Pretty straightforward, yeah? But there’s more nuance here—especially with Solana’s approach. Validators can sometimes slash stakes if there’s downtime or misbehavior, which adds this layer of risk that’s easy to overlook.

My instinct said, “Just stake with the biggest validator and chill.” But actually, diversifying your staking across multiple validators can help minimize these risks. Also, some validators offer higher rewards but come with more risk. It’s a classic risk-return tradeoff, but one that’s often hidden beneath surface-level APR numbers.

And then there’s compounding staking rewards. You can either withdraw and restake manually or use wallets that automate this process. The latter feels like a game-changer for me since it saves time and maximizes yield without constant babysitting. Again, tools like the solflare wallet make this way easier with integrated staking features.

Oh, and by the way, staking isn’t only for hardcore DeFi users. Even casual holders can benefit from passive rewards, but they need to understand the lockup periods and withdrawal rules—otherwise, you might get stuck or face penalties.

Something felt off about the “set it and forget it” mentality some people have about staking. I mean, the ecosystem evolves fast, and so do validator performances. Regularly reviewing your staking portfolio is very very important.

Portfolio Tracking: Your DeFi Dashboard

Here’s a truth bomb: if you’re diving into yield farming and staking, you need a solid grip on your portfolio. Otherwise, you’re flying blind. Tracking your assets, rewards, and performance metrics in one place saves you from costly mistakes—like missing a reward payout or forgetting to restake.

Initially, I relied on separate apps and spreadsheets. Ugh, what a mess. Then I stumbled upon wallets that integrated portfolio tracking and staking management seamlessly. That was an aha! moment. Suddenly, I had real-time insights and could react quickly to market shifts or protocol changes.

Really, the difference is night and day. You go from being reactive to proactive. Plus, with some wallets, you can set custom alerts for reward thresholds or significant APR changes. That’s clutch when you’re managing multiple pools.

Of course, not all portfolio trackers are created equal. Some have clunky UI, others lack support for certain tokens or staking protocols. The solflare wallet stands out by natively supporting Solana’s ecosystem, providing a smooth experience without jumping through hoops.

And yeah, I’m biased, but having everything in one place makes me feel more in control and less stressed about the volatile crypto world.

Wrapping Thoughts: Still Questions, Less Confusion

So, where does this leave us? Yield farming and staking rewards on Solana are definitely real opportunities, but they come with quirks and risks that you gotta respect. Using tools like the solflare wallet can tilt the odds in your favor by giving you clear, actionable insights and secure management.

That said, I’m not 100% sure this is the best fit for every investor, especially if you’re not ready to keep up with the ecosystem’s pace. But if you enjoy learning and adapting, it’s an exciting space to be in.

Honestly, the more I learn, the more I realize how much I don’t know. Yet, having the right wallet and tracker feels like having a trusted copilot on this wild ride. And sometimes, that’s all you need to keep your head above water and maybe even thrive.